Having worked in the technology space for nearly 40 years, some of that time in very senior positions in multi-billion dollar corporations, I have been part of numerous acquisitions during my career.

My personal perspective is that when a technology company is acquired, it’s bad news for their existing customers. I will tell you why.

First we need to understand why one company acquires another, and what their strategic objective is when doing so.

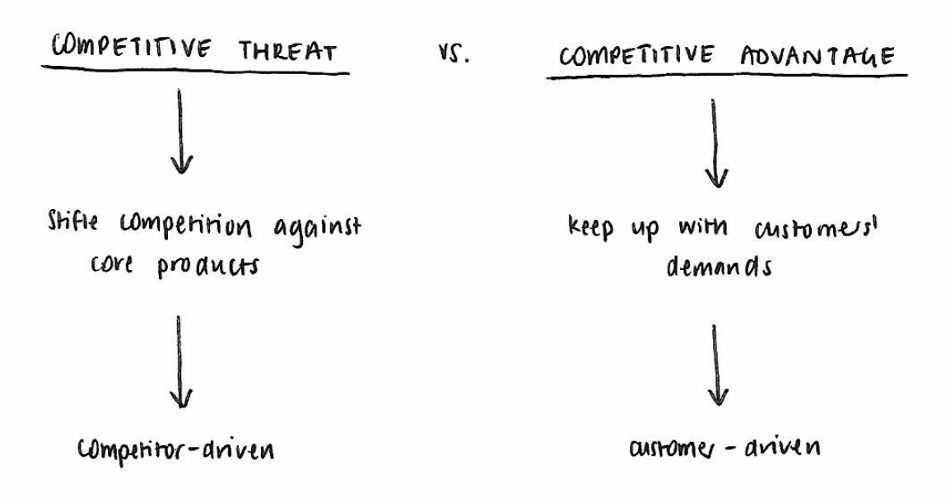

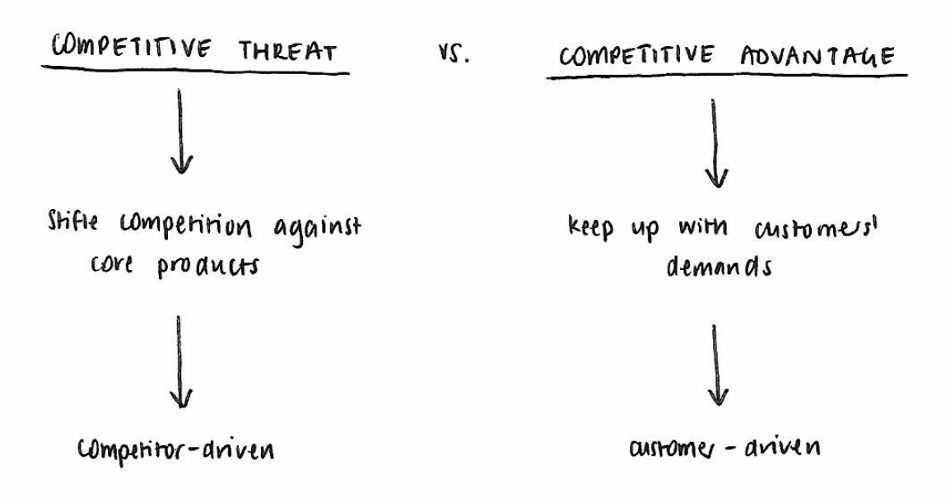

All acquisitions are based on one of two reasons: competitive advantage or competitive threat. Unfortunately, both bode ill for existing customers.

Both rationales have very different drivers. First, let’s look at the competitive threat scenario. When I worked for Cisco in the 90s, Cisco regularly acquired technology companies with evolving "competitive" technology that posed a threat to their larger market strategy and emerging dominance. These acquisitions were mostly to stifle competition against their core products.

Sometimes they reused part of that technology in new products, sometimes they just offered replacement programs and let the existing product die.

Competitive advantage is a very different scenario, although to the outsider it may seem to be the same. When an acquirer undertakes a competitive advantage strategy, it's probably almost always driven by their customers. Maybe their existing offering lacks a piece of functionality that their customers are asking for. Perhaps they are feeling competitive pressure from other technology providers looking to "eat their lunch".

Regardless of the rationale, they will acquire because of what I call the 1+1=3 strategic vision. They may exploit this new technology into their client base, or embed it within their existing offerings to deposition competitors, or potentially to position their "new" offering in new and evolving market segments.

Many hot products or evolving applications are in fact an amalgam of diverse applications retro-fitted to work together. At least on the surface.

In both scenarios, the existing customer base pays the price of the acquirer’s strategic vision and redefined objectives. Costs almost always increase, and the technology used by customers may no longer be supported (perhaps in the short term but probably not in the medium to longer term). The technology might not be onward developed as a standalone application, rather it is retrofitted into much larger solutions.

History is littered with examples of both of these scenarios and you only have to look at recent acquisitions in our market space to see this in action. Both HotDocs and Business Integrity are recent companies to be acquired. We regularly get approached by their clients due to “issues” they are encountering.

These issues might be increased costs, mandatory costly upgrades, lack of development, or lack of support, none of which help your business if you are dependent on the technology.

Finally, we need to look into why companies, especially technology companies, get acquired or seek to be acquired because in almost every case it is a conscious choice to do so.

The rationale is almost always in their underlying funding.

Nearly all technology companies require funding (commonly called runway) to launch their business or to expand their business.

This funding is mostly supplied by Venture Capital, or more recently via Private Equity vehicles whose sole purpose is to drive up perceived fund values, and if possible liquidate the investment at a multiplier.

Often the management of these companies are held hostage to the overarching need of their investors to obtain an exit.

These are facts, not conjecture. In the constantly evolving world of technology companies must adapt or die.

Fortunately, some technology companies offer an alternative choice for customers. They are not subject to these pressures.

By 'alternative choice' I mean privately held, self-funded, specialist technology companies whose ethics and culture are not driven by the needs of external investors, but rather by the people who work there, and the leaders who set the vision. ActiveDocs is one such company. We put our customers’ needs first, and develop technology with their feedback in mind.

Hopefully we are not alone!